Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

725 -

Joined

-

Last visited

Posts posted by UrmaBlume

-

-

Urma,How can we calculate trade velocity ? Is there any indicator? can be buit it in Radar screen?

Please let me know.

John

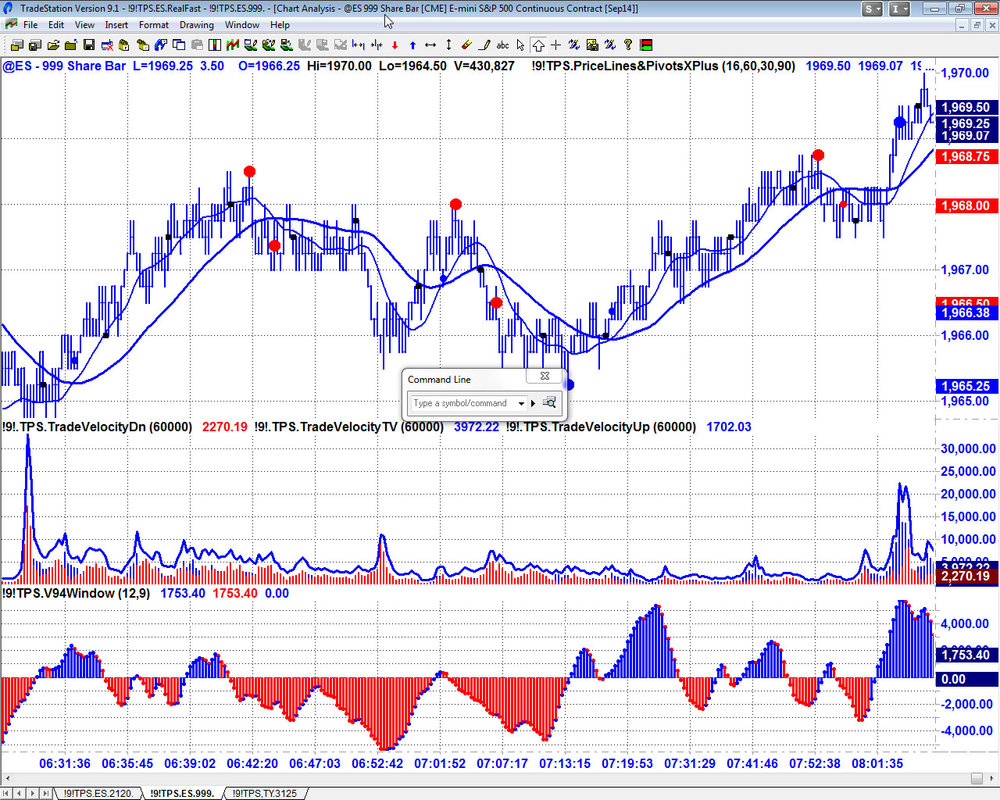

Trade velocity can be very useful in locating the kind of trade that forms local intra-session extremes.

The idea is that trade that is executed by computer is faster than a set of random orders placed by human traders and that small/retail traders don't have the wherewithal for computed executed entries and exits.

One prime issue when using the velocity of trade as a trade decision support mechanism is that while arbitrageurs often use computer execution when deploying premium arbitrage strategies, at the same time they might be making large computer executed buys or sells in a derivative market(i.e., futures) - they are also making the opposite transaction in the physical markets..

That said, attached is a spike in buy trade velocity taken this morning at the open of ES which, as of this writing is also the low of the day.The chart is noted in PST and you can see the buy spike in trade velocity in the middle graph at the far left which is just at today's open in ES.

The direct answer to your question is that that we use several different algorithms to calculate the velocity of trade and which one we use is dependent on instrument, sensitivity and which trade type we are trying to identify.We, as of now, don't use this indicator in Radar Screen buy will add such to our indicator pack in the near future.

cheers

pat

-

Being a one time boat owner, I can relate...The old saying rings true: "If it flies, f*cks, or floats rent by the hour".

An extra parameter from eco 101 - "If it Floats, Fucks or Flies, lease it in the absence of positive cash flow. Boats,Women and Planes - sometimes they pay, sometimes not. Yet still nice to have around. Still have a couple and still miss all those that are gone.

Of note are the various markets and prices. With duties aside the prices for both boats and planes are pretty stable worldwide. On the other hand a pleasant short time in Bangkok will cost just a bit more than an ounce of silver with a great overnight worth the price of a barrel of West Texas Crude, in Vegas that same quality of overnight will cost the price of an ounce of gold. Through all of that and around the world a Newer used Piper Meridian Turbo or a nice used 60 foot pilot house cutter will cost about $1,500,000 no matter where.

UB

-

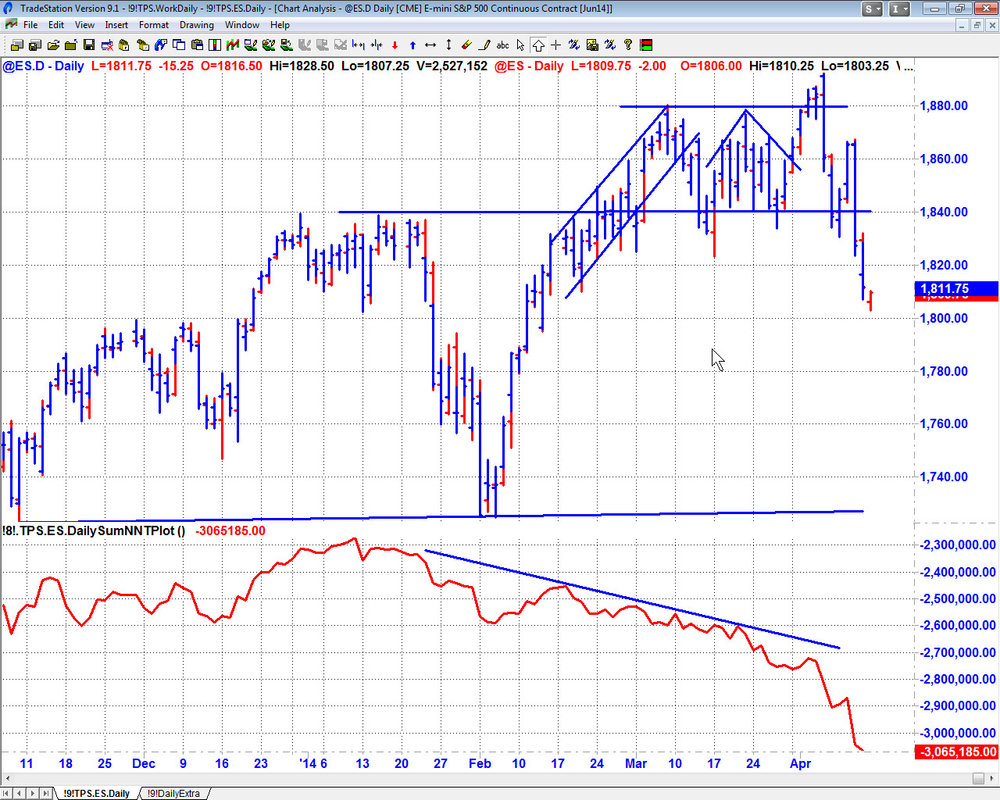

While all of my trading is much shorter term and done by automated systems, I have built a longer term indicator that I use for background information.

The attached chart is of an overlay of day session day bars over the 24 hours session bars in ES.

The indicator takes the net of buying and selling volumes for each day from a 1 minute chart and posts those values to a global variable which then makes the cumulative total of those values available to the day chart.

I take very little stock in divergences between price and price based indicators but the indicator posted on the attached chart only sees buying and selling volumes with no input from price.

The divergence is stark and has been building for almost 2 months. It also says that the divergence has not been satisfied. Divergences of this magnitude with this indicator in the past have led to well over 100 point drops in the ES.

Again while this indicator has absolutely no influence on my trading, it tells me that 1) we are due a consolidation/correction from this down move but 2) new highs are unlikely in the longer term.

My work with probabilities tells me that the shorter your projection/trade view, the easier/more likely it is to be right which is why I don't play outside the session. That said, I started recommending puts to my longer term friends 2 weeks ago.

This is a link to the graph that is attached below.

Another point of interest about this particular chart is that you might note that on most up days there is red at the bottom of the chart and on most down days there is red at the top of the chart. This denotes two points of interest:

1) News and trade follow the sun around the globe. Overnight news is first detected and acted upon during the Asian session and then later during the European session which means that if the news is significant it has already been acted upon by the start of our day session and we are not like to see prices at that extreme again that day, ergo, on more than half of the days, the best price of the day happens outside of our day session.

2) The nite session will often have the same or bigger price moves than the day session and those moves happen on about 10% of the day session volume. The explanation for these big moves on such lite volume is that there is no opposing activity. The trade that happens during those hours is mostly done by commercial/professional traders and they are usually of a like mind so very slim offers oppose their buying and there are very lite bids to absorb their selling.

cheers

UrmaBlume

-

what on earth are you having in that jar?

TW

OOPS.

Wasn't too clear when I snapped that.

Cheers

UB

-

Hi Urma,I wasn't challenging the quality of the recommendation, nor looking for an argument.

Best wishes,

BlueHorseshoe

Thanks Blue, me neither.

BTW, I see UK. I used to office in Finsbury Circus.

cheers

UB

-

Attached is a zip with 4 EL PDFs including a 1200+ page reference to all reserved words and functions.

UB

-

For the first time in 200 years there are bald eagles nesting on the 3 rivers in Pittsburgh.

This is a link to a day and night webcam that shows Mama and Papa eagle raising three eaglets. They catch and bring fish and other critters as food and in a couple of amazing loops chase off predators. A racoon foolishly tried for the babies and one look at mama eagle all puffed up ready to serve racoon to her babies and he was gone.

This is a shot of my desk and one of those monitors watches the eagles 24/7.

Enjoy.

cheers

UrmaBlume

-

Hi Urma,I don't doubt that - but if you post such a singular endorsement it's likely just to be taken down by the moderators. As soon as you acknowledge that he is one option amongst many, you're given much more general information and then stating a preference.As well as this, isn't it always good to point out to the OP that EL is relatively simple to learn to code (at the level the OP currently requires) and will serve as an invaluable tool in their development as a trader, allowing them to test the validity of their ideas before committing money to a strategy?Maybe I should stop interfering Kind regards,BlueHorseshoeBlue,

If I was looking for a coding or any other service, a singular endorsement from an experienced user would be EXACTLY what I would be looking for. Plainly in any group of practitioners there is an average level of competence and a small group, third standard deviation, that excels.

Less than the third standard deviation of traders succeed and I would think it obvious that such a level of trading, coding, understanding and execution would require support of an extraordinary level of competence.

While EL is a great tool for system development, it is wrong and misleading to advertise that it is easy to learn at a level that will produce profitable trading systems. If that were true you couldn't get a cab in NYC, all the drivers would be watching their bots.

The average or the lowest common denominator doesn't make it in this biz. Most everybody on this forum, including vendors, lose in their trading and will continue to lose until the pain makes them leave the markets.

It is not a business for everybody and to foster the idea that everybody has an equal chance of success only leads to loss and heartache. The vast majority, for one reason or another, are just not equipped for this biz and certainly history documents this fact.

Only the top few percent of traders and systems succeed in the long run and I put Martin in the top few percent of consultants. I say that not because I use his services and like the guy but because I have tried many others and find him the best and I think that this kind of information from an experienced EL developer is way more valuable that something as pale and bland that there are many other consultants.

All men are not equal in ability and all consultants are also not equal in ability and in a world where only the top few make it, quality, not price, is the prime consideration.

UB

-

While JAM is a very well respected company, it is worth noting that there are other programmers out there ;)You'll find a list of those endorsed by TS (including Miller) on their website. Whoever you use, I would expect to pay a minimum of around $90 per hour . . .Kind regards,BlueHorseshoeAll due respect Blue, but over the years I have used a selection of those listed and found Martin to be the best by far.

As to rates, his is even higher, $125 Eu per hour and he is so much better than any of those listed that he is well worth it. When you are looking for help of this kind, the rate should be far down the list of selection criteria.

Deep into execution issues with TradeStation I spent lots of $$ looking for answers from the list you mention. I finally found Martin and my issues were solved in less than an hour.

UB

-

Your OP didn't say anything about "interval bars." The code provided will perform as per your specs.

IMHO your strategy is a recipe for disaster but if you want custom coding for this or any other strategy let me recommend Martin Miller of JAM Strategy Trading Martin wrote the TradeStation Wiki, knows more about TradeStation and Easy Language than the technical staff at TradeStation, is great to work with and the best there is for TS Consulting.

I have worked with him for years and wholeheartedly recommend him.

His contact info including phone, Skype and email is here.

Cheers

UrmaBlume

-

anyone has a sample code for the following?buy whn stoch<30 and exit 5 bars from entry

if next day stoch is <30 buy another unit and exit 5 bars from entry

if next next day stoch is <30 buy another unit and exit 5 bars from entry

try code them but the second and third entry all exit at the first exit altogether rather 5 bars from entry

Vars: Stoch(O), Count1(0), Count2(0), Count3(0) ;

If MarketPosition <= 0 then Begin

Count1 = 0;

Count2 = 0;

Count3 = 0;

end;

If Count1 = 0 and Count2 = 0 and Count3 = 0 and Stock < 30 then begin

Buy x shares this bar on close;

Count1 = BarNumber

end;

If Count1 <> 0 and BarNumber >= Count1 + 5 then begin

Sell X shares this bar on close;

Count1 = 0;

end;

If Count1 <> 0 and BarNumber = Count1 + 1 and Count2 = 0 and Stoch < 30 then Begin

Buy x shares this bar on close;

Count2 = BarNumber

end;

If Count2 <> 0 and BarNumber >= Count2 + 5 then begin

Sell X shares this bar on close;

Count2 = 0;

end;

If Count1 <> 0 and Count2 <> 0 and Count3 = 0 and BarNumber = Count2 + 1 and Stoch < 30 then Begin

Buy x shares this bar on close;

Count3 = BarNumber

end;

If Count3 <> 0 and BarNumber >= Count3+ 5 then begin

Sell X shares this bar on close;

Count3 = 0;

end;

Good Luck, you will need it.

UB

-

I was using the following code[intrabarOrderGeneration = false]

SetExitOnClose ;

to close all orders whether long or short when session/day is ending.

It was not being executed and had to call the tech support of TS and they mentioned that the orders have to be specifically closed by custom code something like

if Time >= 1355 then

Close all orders

How do we write "Close all orders" in Easy Language. There could Long or Short Orders. I want all to be closed.

While it will take 2 statements, this should do it.

If MarketPosition > 0 and Time >= 1355 Then sell CurrentShares this bar on close;

If MarketPosition < 0 and Time >= 1355 Then Buy to Cover CurrentShares this bar on close;

MarketPosition will return a +1, -1 or 0 depending on whether you are long, short or flat.

CurrentShares will return the number of shares/contracts in your position.

Cheers

UB

-

Hi there, I really don't know where to begin with....I trade currencies more than 8 years now...this is what I do, day in day out....no stocks, no nothing....Advantages?...come on, don't make me pick the obvious 24/7 trading, etc.....Maybe it's only me, I'm an economist, MBA graduate in International Business, American University, and that being said I like to compare economies around the globe. Well, if you do that, you might as well look at their currencies. Well again, if you do that as well, you might as well trade those currencies. Combine the above with technical analysis. And consider the satisfaction of beating the market year in, year out. And then you would not want to trade anything else than forex, as those markets look like peanuts on the global arena/macro-economic thinking/technical-fundamental reasoning, etc.From my point of view, everyone else is either incapable of grasping the reality above, or lacking the intellectual capacity to do that.

So the easiest way is to trade volumes....

....what a crap........sorry for that, I will ban myself :crap:TW

....what a crap........sorry for that, I will ban myself :crap:TWAll due respect to your background in Macroeconomic stats etc, short term trading is about short term technicals and in Fx trading all of your technicals are price based with no consideration of volume, depth or order/money flow.

In more fully disclosed markets, the trader who only uses price based inputs is at a disadvantage to those able to read volume velocity, balance and transaction size as well as market depth.

As to your condescension based post, Trading Wizard, as an online poker player I find that those with such screen names as PokerStud, really aren't. Kind of like your 100 ton toy boat license.

UB

-

Hi there,yes...like any volume analysis, you are considering only the one offered by your broker...not the whole market.....that is the problem with all the volume based analysis.

TW

That's only in the Fx markets.

Wiz,

I never understood, when there are so many other choices, why one would trade a market were you never have the slightest idea of volume, order flow, size transactions or the participation of size/commercial traders. Could you please tell us?

I have always considered Fx a sucker's market and the only reason people traded it was because they first didn't know any better and second because they didn't have the resources either fiscal or intellectual to trade anything else.

Wiz - I respect your posts, your position on this forum and your license with the Merchant Marine - Please show me the errors in my thinking.

UB

-

Professionals also avoid usage of EA in trading .It is not a popular way of trading .If we depend on EA"s cannot develop trading skills in our self. Manual tradig with self analysis is best way of trading.EA are just type of software that work in pre defined instructions.Eas are for cluless traders.What completely escapes this completely "clueless," certainly not a successful trader, is that most of the money that is made in trading most anything today is made by automated trading systems.

If the method is precise enough to be taught or expressed it can be programmed.

Certainly it is true that most traders do no use automated systems. It is also true that most traders, especially traders like this guy, do not make money. AT the same time it is also true that First, most of trade today is done by automated systems and second most of the money that is made today in trading today is made by automated systems. and third most of the money that is lost in trading is lost by traders who do not use automated systems.

I have a labrador who can put those three together and come up with the conclusion that the clueless one is the OP himself.

UrmaBlume

-

I Use two human beings to process and input trades , they are like Eas. They can handle bucket shop requires that eas can't .Real traders don't use eas.Even more crap, most of the trade in almost every market is done by automated systems and those systems make more money than all the successful human traders combined.

Plainly you are way out of touch with the realities of today's markets and the technologies used by successful operators to trade them.

As to bucket shops, haven't you noticed that most of them are gone?

Of all the lame BS posted on these forums, yours, not to mention your attitude towards other traders and even vendors, is the lamest.

UrmaBlume

-

Hi All,I am new to Emini and am doing a bit of research on it. I came across this exceptional site and thought I should ask my question here.

Pretty sure this is asked before but I could not find the answer doing a search......

When I papertrade with ThinkorSwim, I was always "charged" a margin fee (the $4975) when trading after hours. Since I do not have time to trade during the day time, I wonder if trading at night requires a higher margin? I understand that if you hold a position overnight (i.e. pass 5 pm ish) you have to have 5K ish per contract, but what about entering and exiting a position afterhours? Is this still considered as "intraday"?

Any suggestions are much appreciated. Thanks!

Because of lower liquidity, margin requirement for trades outside the 405 minuted day session have always been higher than the day margin rates.

Margin requirements for both day and outside the day session will vary broker to broker.

UB

-

She is a Beauty. A Ketch or a Yawl? I could never remember, something to do with the position of the aft mast in relation to the helm.My ticket simply reads, Endorsements: Radar, Towing, Sail.

It's a ketch. It is not about the helm but rather the rudder post. In a yawl the mizzen is aft of the rudder post, in a ketch forward.

The only reason that there were so many "split rigs" in the past has to do with sail size and sail handling. Now that all but the spinnaker are on rollers the trend is towards cutters. The difference between a cutter and a sloop is that the mast is in the middle of the boat in a cutter.

I think the one endorsement you should be looking for is "Upon Oceans."

UB

-

Mystic,

I didn't know you were licensed. Mine reads:

MASTER OF STEAM OR MOTOR VESSELS OF NOT MORE THAN 1600 GROSS REGISTERED TONS (DOMESTIC) 3000 GROSS TONS (ITC), UPON OCEANS; ALSO RADAR OBSERVER - UNLIMITED; ALSO OPERATOR OF UNINSPECTED TOWING VESSELS UPON GREAT LAKES AND INLAND WATERS

While currently boatless attached is a pic of my last boat while in Hawaii after a sail from San Diego.

Our new member seems to be of the opinion that success in trading in any time frame is merely the selection of a system and a bit of coaching.

I believe he should be aware of the following from another post:

In trading, being right is and always has been more important than being big/rich.

You should know, however, that barring divine intervention or spontaneous intellectual combustion, it WILL take some money, a lot of time and effort and even with years of effort your odds of ever making long term profits are greater than 20 to 1 against.

Few have the stamina for a trail that often includes years of disappointment and even fewer have the instinct or intellectual capacity to even have a chance at long term success.

There is nothing that says that you can't be one of the few. But before you embark you should consider who the very, very few are that make all the money and their level of experience and resource.

The competition for every dollar of trading profit is fierce. Your competition is not the posters on this or any other forum, it is the traders in high tech trading rooms and organizations like Goldman who are backed by legions of engineers, software developers, banks of servers and billions of dollars.

The odds of anyone spending a few months reading books and forums and practicing with a few thousand dollars worth of hardware, data and software and succeeding are way worse than 100 to 1 against.

Cheers

UrmaBlume

-

Zup,

Your point about the use of either indicators collapsed into functions or objects for order placement is well taken. But I still have my doubts.

While I am not familiar with that platform because I have never even considered fx trading, I am deeply familiar with TS and believe my code to be both clean and efficient.

Why don't we collaborate on even just one of your 30 line ideas and I will build it, test it and send you both the code and the results.

The main point I was raising was about broker reliability which you said doesn't exist and I say I can write code that will execute within TradeStation with 100% reliability with the givens that it trades intra session and trades with market orders. Also it needs to be either US futures, US Stocks or fx via TS.

What's to lose? I used to office in Finsbury Circus so we both might enjoy a chat.

cheers

UrmaBlume

-

:rofl:Trading might not be a "science" but you can apply scientific method. Its not rocket science either.

I dont really trade automated systems these days due to reliability issues, but if there was a broker out there responsible enough to take this stuff seriously (and there isnt) I could write a profitable automated strategy in about 30 lines of code, and I suspect that a lot of the quant boys could do it in less.

Most probably the reliability issue is not so much about the broker's platform but rather with your code.

If we are talking about a system that trades intra session, trades either US stocks or US futures, can be operated with market orders and produces an ROI > 20% then I doubt and would bet that you can not write such a system in 30 lines of code or less.

While I can not speak to all brokers I can say that over the years I have code that executes in TradeStation with 100% reliability. That DOES NOT mean that every execution produces a profitable trade. It DOES say that every entry, exit, stop or take profit order was executed exactly as programmed.

As to OilFxAmateur's discussion about systems, while a system can include discretion, that discretion must be clearly defined or it is not a system. Ergo the system can be programmed and tested. The reliability of back testing is as much a function of the developer's understanding as is the development of the system.

The systems I run every day in TradeStation consider several different trade types, reversal, continuation and mean reversion and they contain something over 1,000 lines of code. The risk management part of each of these system, the parts that include stops, take profit and sizing, alone take more than 30 lines of code.

UrmaBlume

-

One can always spot those without any, any, knowledge or experience with how funds and money managers operate.

I bet this guy has other interesting theories about area 51 and a whole range of different conspiracies.

UrmaBlume

The markets find themselves near all time highs once again, just two weeks after it appeared the sky was falling. So what gives? Is the market headed for another 30% move higher in 2014 or is there an epic collapse on the horizon? All signs point to a classic scam by large institutions to lure the small investor into the market prior to a 2007 type fall later this year and in 2015.The media and analysts have piled back on the buy-the-dip commentary. Investors are pushing more capital into the markets every day, in many cases they are borrowing money to do it. The use of margin is at all time highs. The last time it was at all time highs was in 2007, prior to the financial collapse. History tells the truth and ultimately there are far too many similarities to ignore. For the record, the similarities not only mimic 2007 and 2000 prior to the epic drops but also going back as far as 1929. Many 'experts' and media commentators are saying there will be no collapse. Considering they are manipulated by the big banks...of course they would say that.

First, it is important to understand the game that is played. Large institutions use emotion to take money from the smaller investors. There are 90 million Americans that invest and less than 1% avoid being caught in this game. How does it work? Using the media and analysts along with the stock market moves, they pull the strings of investors to get them in and out when they wish. That means getting them to buy at the highs on a market and getting them to sell at the lows. Have you ever wondered why everytime you enter a stock it seems you are on the wrong side? That is the game being played on a minor scale.

How do you avoid the game? Simply do the opposite of what your 'gut' is telling you. If you feel like you should buy the market? Stay in cash or short it. If you are extremely scared, too scared to buy the market...then buy it. If the media is pumping Twitter (TWTR) like crazy at $75 (like they did a few months ago), short it. If the media and analysts are trashing a stock, buy it. A great example was when J.C Penny fell just a few weeks ago to $5.00. The media was trashing it and many gurus were saying it was going to '$1.00'. Yet here it sits with a 20%+ gain at $6.10. This works so well it is almost scary.

Why do the institutions do this? Simply put, it is to profit. It all comes down to the mighty Dollar. When the markets or a stocks get too extended, the big players need to get out. By hyping those stocks, they lure the small investors into the market and can sell right to them. Once the institutions unload, the markets fall and the small investor loses their money. When low enough, the fear hype will reach a level that causes 'long term investors' to sell their positions right to the institutions. Once this happens, the markets can go higher again.

This latest rally and bullish sentiment in the media and analysts is just a way for the big institutions to get you in the market before the drop it. Read the signals and think logically.

Gareth Soloway

-

In trading, being right is and always has been more important than being big/rich.

You should know, however, that barring divine intervention or spontaneous intellectual combustion, it WILL take some money, a lot of time and effort and even with years of effort your odds of ever making long term profits are greater than 20 to 1 against.

Few have the stamina for a trail that often includes years of disappointment and even fewer have the instinct or intellectual capacity to even have a chance at long term success.

There is nothing that says that you can't be one of the few. But before you embark you should consider who the very, very few are that make all the money and their level of experience and resource.

The competition for every dollar of trading profit is fierce. Your competition is not the posters on this or any other forum, it is the traders in high tech trading rooms and organizations like Goldman who are backed by legions of engineers, software developers, banks of servers and billions of dollars.

The odds of anyone spending a few months reading books and forums and practicing with a few thousand dollars worth of hardware, data and software and succeeding are way worse than 100 to 1 against.

UrmaBlume

-

There are some great threads out there in forums and you do meet some good people , but these are only maybe 2 to 3 % of forum posters .You get mostly freeloaders who like to be secretive , if they have anything worthwhile.And sometimes you meet self deluded, self inflated, Luddite wannabe know nothing bullshit peddlers.

UrmaBlume

Custom Programing

in TradeStation

Posted

As TradeStation's oldest customer and after using a handful of different easy language consultants, I believe the best by far is

Martin Miller

Support@JamStrategyTrading.com

If you look at the TS Wiki you will find mmiller wrote most of it.

cheers

UB